Optimizing EUR/USD Hedging Strategies: A Data-Driven Approach

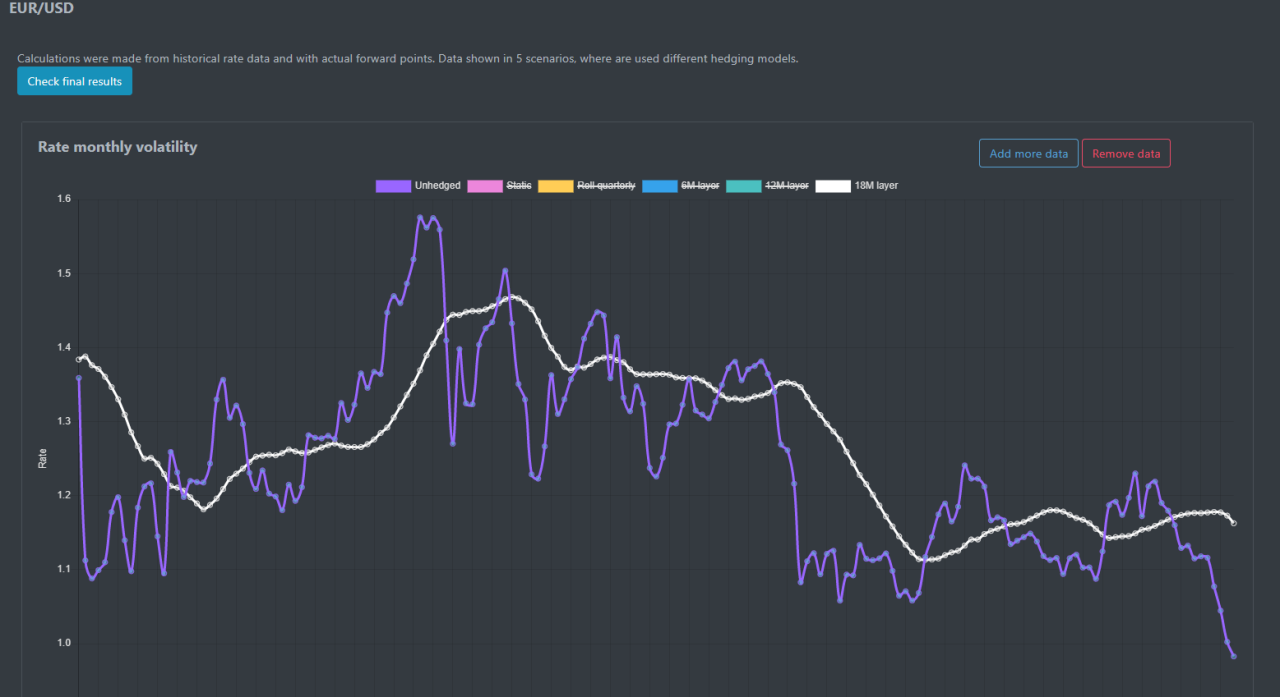

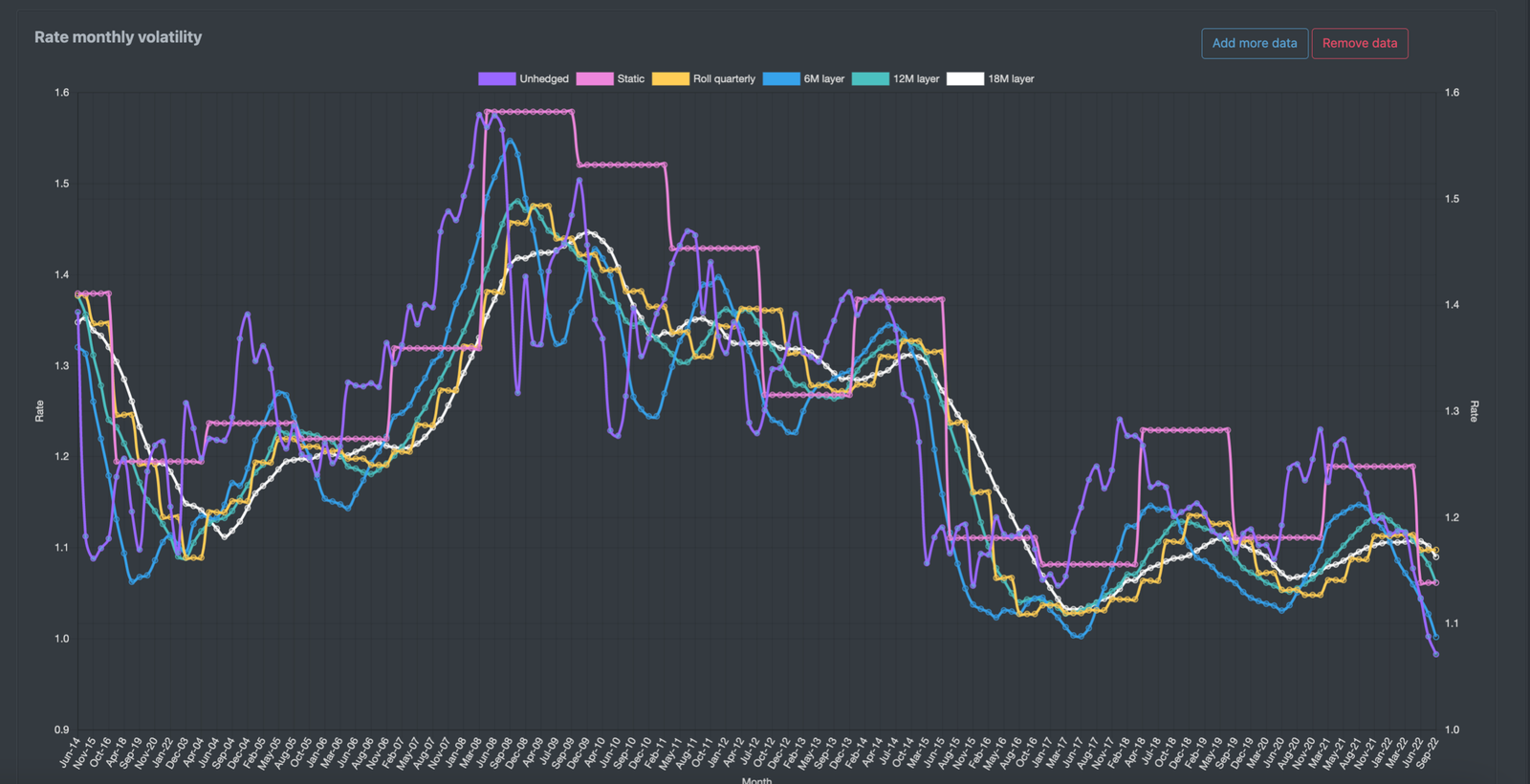

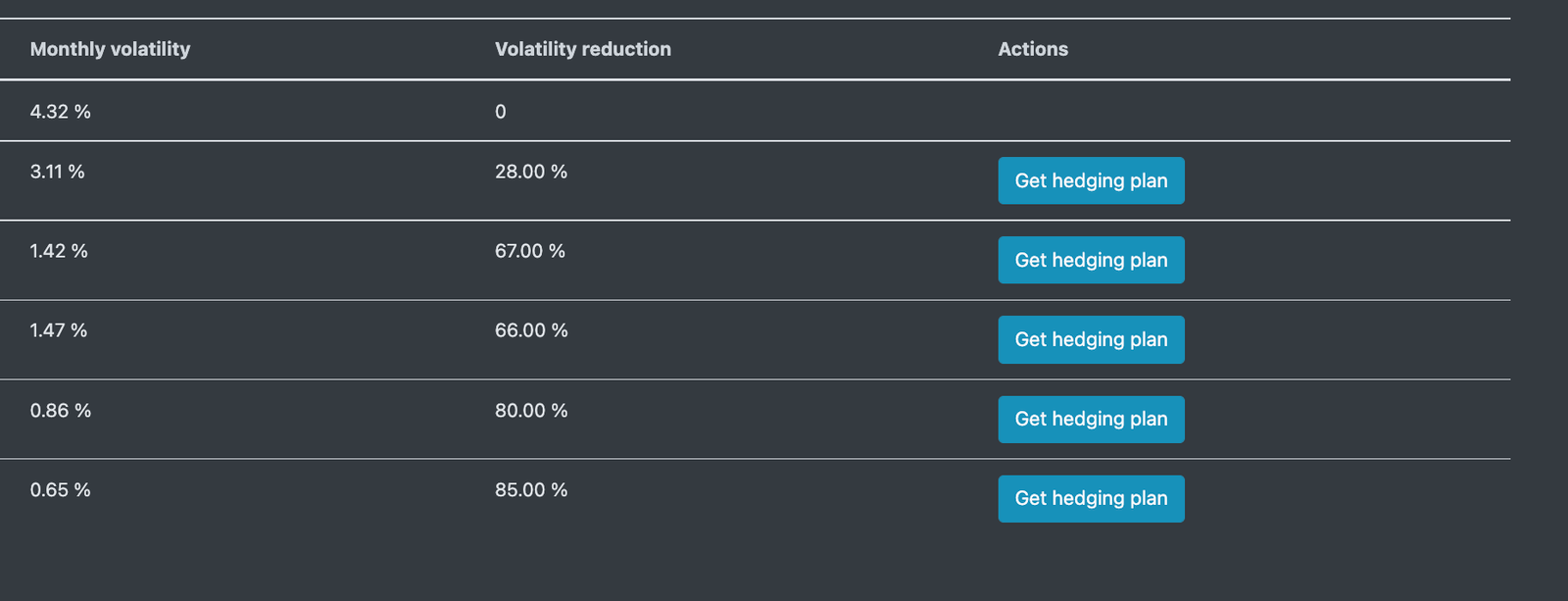

In the constantly evolving landscape of forex risk management, a dynamic and data-driven approach is imperative for businesses aiming to thrive amid market uncertainties. Focusing specifically on hedging EUR/USD forecasted cashflows requires a thorough analysis of various factors, including interest rate differentials, market valuation, and the presence of carry.

This tailored approach ensures that hedging strategies are not only effective but also align with the unique dynamics of the forex market.

The evaluation of currency pair valuation serves as a foundational step in designing effective hedging strategies. Real Effective Exchange Rate (REER) analysis, which incorporates the Trade trade-weighted index and Consumer Price Index (CPI) deflator for a basket of 41 currencies, provides crucial insights. A current REER for the Euro at 92, significantly deviating from its historical age of 109.4, signals relative undervaluation. Conversely, the US Real Effective Exchange Rate, historically averaging at 121, stands at 116 presently.

Addressing the carry trade dynamics, in instances of a Negative Carry scenario for EUR/USD, the adoption of Option-Based Instruments emerges as a prudent strategy. This is particularly applicable when the USD exhibits higher interest rates than the EUR, creating a negative carry. Options offer flexibility, allowing companies to mitigate risk without committing to a fixed exchange rate, acting as a valuable shield against potential losses.

When the EUR/USD pair is deemed undervalued or maintains a neutral stance, the utilization of a Participating Forward contract proves effective. This instrument enables businesses to capitalize on potential currency appreciation while securing a minimum acceptable exchange rate, striking a delicate balance between risk and potential gain.

Conversely, in situations where the EUR/USD pair is considered overvalued, options become the preferred hedging instrument. Options provide the flexibility to hedge against potential depreciation while allowing for potential gains should the exchange rate move favorably. This adaptive approach aligns with the need to protect against downside risks while maintaining room for potential benefits.

In conclusion, the selection of an appropriate hedging strategy for the EUR/USD pair demands a deep understanding of market conditions. By considering factors such as carry, market valuation, and interest rate differentials, companies can tailor their approach to specific scenarios, ensuring resilience and agility in the ever-evolving forex landscape.

Emphasizing the importance of regular review and adjustment of hedging strategies remains paramount to maintaining their effectiveness over time. Through a proactive and informed approach, businesses can navigate the complexities of forex risk management, safeguarding forecasted cash flows and ensuring a robust financial position in the global marketplace.

Corphedge, positioned at the forefront of this dynamic global economy, emerges as a pivotal partner. Offering an analytics platform that goes beyond conventional strategies, Corphedge leverages comprehensive data analysis and a profound understanding of market conditions to empower clients. With Corphedge, businesses not only navigate forex risk management with confidence but also gain the adaptability needed for sustained success in an ever-evolving financial landscape.

Moreover, in the current era of digital transformation, technological integration becomes a crucial aspect of effective forex risk management. Automation, machine learning, and artificial intelligence enable businesses to process vast amounts of data in real time, providing actionable insights and enhancing the precision of hedging decisions. The ability to harness cutting-edge technology ensures that companies not only keep pace with market dynamics but also gain a competitive edge in their risk management strategies.

In essence, the convergence of advanced analytics and technology further strengthens the foundation of sound forex risk management practices. As businesses embrace these technological advancements, they position themselves not only to navigate the complexities of the forex market with confidence but also to proactively respond to emerging challenges and opportunities.