How to reduce EURUSD volatility? Volatility can be controlled!

29 October, 2022 | CorpHedge

Afraid of #EURUSD volatility?

We see huge volatility in all the financial markets - even safest financial instruments (bonds) face high volatility environment. Volatility can be challenge for businesses that underestimate importance of volatility in currency markets, especially if has regular flows in foreign currencies.

The purpose of #hedging is akin to having insurance. The biggest listed companies, for example, usually understand how important to reduce earnings volatility and many of them choose such benchmark for measuring success of hedging programmes.

Create your #hedgingprogramme based on data and statistics, track results, get notifications, analyse at Corphedge platform. Passive hedging, like passive investing approach can be very effective long term strategy for your business and increase competitiveness substantially. The biggest shocks, black swans, or smaller force major events, can’t affect your rate by much. Stable, forecastable, no time time consuming business currency risk management approach both with #Corphedge

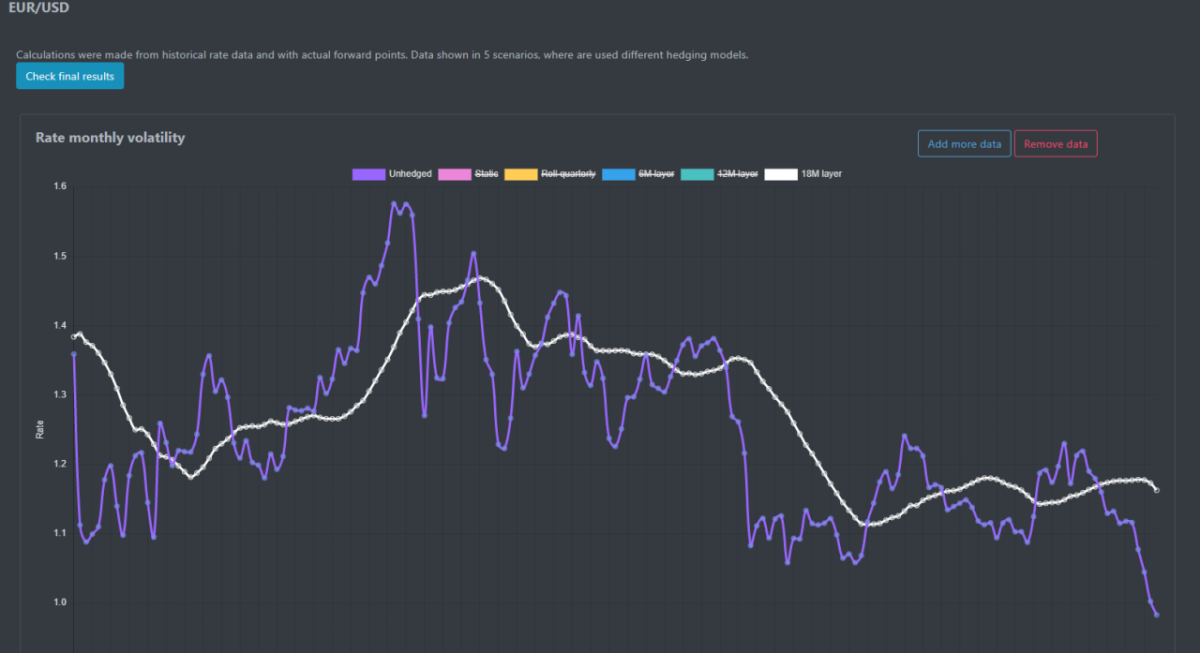

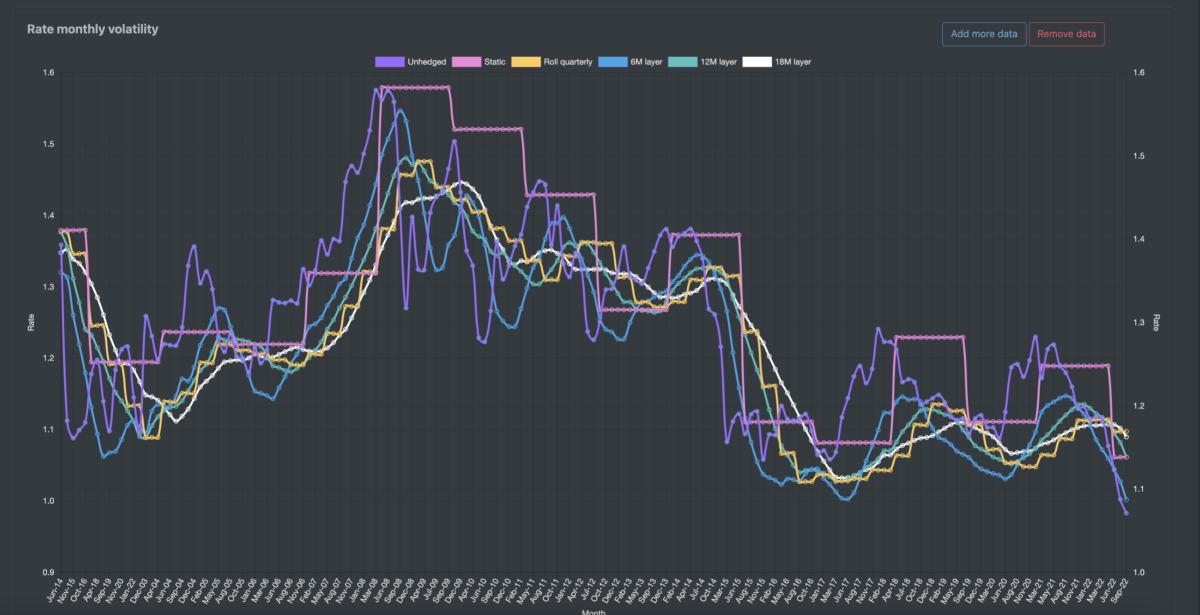

This is how EURUSD rate would look like with some of the passive hedging strategies vs unhedged SPOT rate:

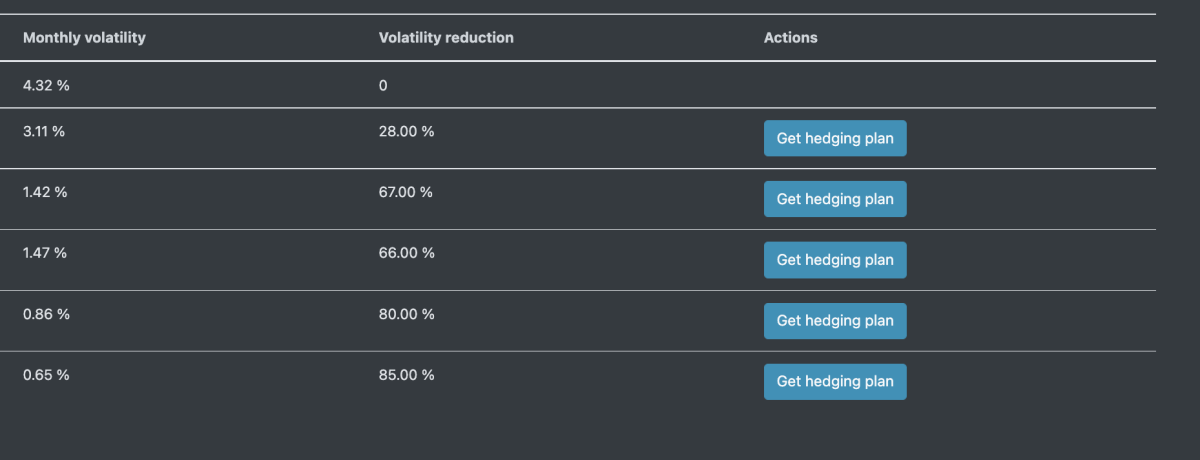

This is the monthly volatility of SPOT and how much it is possible to reach with different strategies. Some of them can offer 80 percent and more reduction in Volatility.