Hedging based on value at risk

| CorpHedge

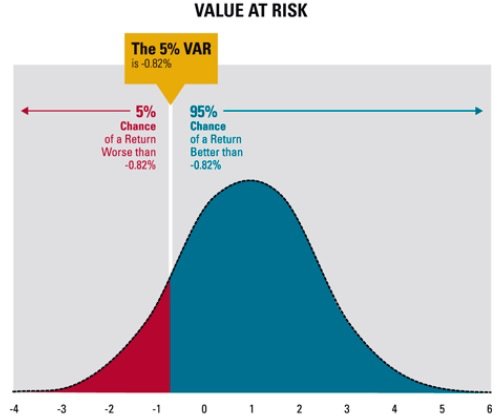

As multinational companies move towards sophisticated, data-driven approaches to managing risk, they have found a solution in Value at Risk (VaR). The same strategies can be used for mid-size businesses as well. Corphedge has a mission to offer SMEs the same FX tools, that multinational companies use, but produce it simplified and user-friendly. VaR analysis gives a measure of the portfolio’s overall risk that is often expressed as a maximum one-day/week/month loss up to a given percentile.

VaR method helps to determine how much of currencies exposure (that otherwise would cause FX results in the P&L) companies need to hedge for the coming months, for example, a European manufacturer applies VaR to calculate the risk on its expected cash flows from operating activities on a 12-month rolling horizon with 95% confidence. Another example: a company is looking for the best costs/benefits ratio and sees that unhedged VaR would be some 100k EUR, whereas hedged VaR is below 20k EUR.

Corphedge users can determine hedge ratios based on the risk profile. Usually, it is possible to reduce hedging costs by hedging less, but increasing VaR a little - this approach usually helps to save money for corporates for hedging and determine hedging percentages.

With Corphedge users can see VaR from their total future requirements (based on cash flows data users upload) as well as see how many hedges in different currencies will reduce VaR. After hedge deals are done, users can see re-calculated new reduced VaR, which in turn furthermore proves that FX hedging lowers VaR.