CorpHedge experts help you navigate through risk safari!

Modern software to store, value and manage your FX risks with

Operational expert advice!

Operational expert advice

- Experts will help you analyse your FX risks, add data into the platform and navigate through the platform step by step.

- You will be alerted if markets reach your pre-set levels and will be sent your portfolio report each week.

- "Risk Safari tour'': Clients can request a private zoom call from their personal manager (Live conversation limit 20 min. weekly).

- Together, you will navigate through your portfolio and look for "elephants in the room" while trying to avoid all and any "black swan" scenarios.

- Experts will also introduce macro economical context, which will give insight into important technical levels currently at play in the market.

- Our experts will help you to get the best trading conditions from banking partners or brokers.

ANALYSE BEFORE YOU START - Reduce your FX exposure

- CorpHedge uses historical data to backtest differrent strategies and compare them with each other.

- Corphedge automatically generates trading plans according to your data and based on your required reduction of volatility.

- Send your plan to your bank/broker dealer and track your portfolio performance in a single platform.

- Reduced FX exposure means reduced profit volatility. That's what FX looks like at most of the large listed companies. Now each business can manage FX risks using the same secrets.

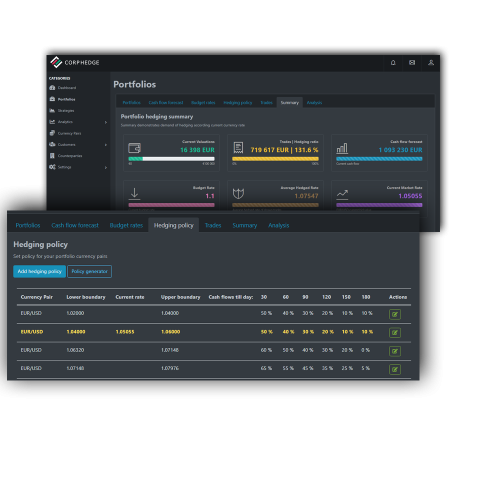

Initial data and portfolios

- Add your data and create portfolios with different currencies based on your specific business operations and needs.

- Add different cash flows with different timelines easily by importing it from your existing systems.

- Add internal company regulations for FX hedging.

- Add your budget.

- Add your executed trades.

- Get reports on how much is required to hedge based on your strategies.

- Filter historical and current data, sums by month or week periods.

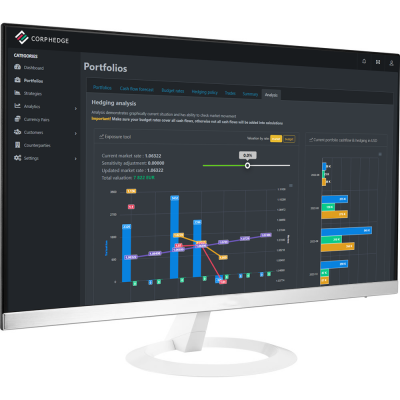

Ineractive FX Exposure tool

Analysis tools allow evaluation of how exposure could differ if the current rate moves up or down.

Analysis can be made by using your current market spot or budget rates for trades and unhedged cashflows which helps prevent overtrading.

PACKED WITH ADDITIONAL FEATURES YOUR TEAM WILL LOVE

Notifications

Numerous different notifications regarding your portfolio and market events sent via SMS, email or internal messages

Risk Safari Tours

Weekly 20 min live conversations. No robots, no automations- real humans

Track important metrics

Summary of all parameters in every portfolio dashboard

Custom configuration

Possibility to configure customer zones based on individual requirements

Reports

Creation and sending of reports to any given email, without even entering the platform

Cloud Storage

Accessible from any device and any place where internet is present in a secure way