Manage FX risks as easily as a professional

-

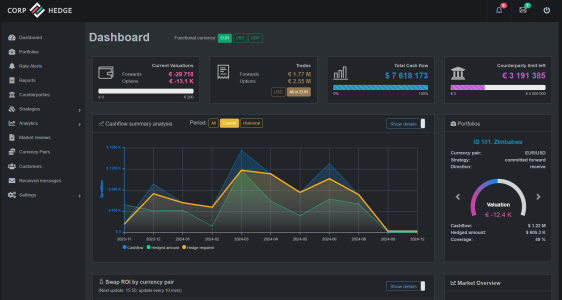

Business owners, accountants, and CFOs use Corphedge to track FX risks and manage them in a simple way.

-

The user-friendly platform provides solutions that simple spreadsheets fail - Corphedge delivers reliable real-time information to analyse risk, value positions, and publish the necessary reports.

-

„Money makes money“: understand exposures, budget effectively, commit to partners and clients, protect your cash flows, reduce volatility and costs. Boost your profits!

Don't think, that FX is not your business - FX is your business, because it affects the company’s bottom line!

Companies suffered reduced earnings in the prior two years due to avoidable, unhedged Forex risks. Furthermore even if they were using hedging, they usually did so without understanding all the possibilities.

Mostly insufficient knowledge of such risks and no resources to manage them.

SMEs that derive much of their revenues from abroad may struggle to remain profitable.

100 percent of larger enterprises hedge FX risks, while only 44 percent of small and medium-sized enterprises (SMEs) do.

Risk safari blog

Big news! 🚀

CorpHedge has been officially registered as a European Union Trade Mark — reinforcing the trust and security behind our financial risk-management solutions.

Proud to be growing across Europe.

CorpHedge Platform Successfully Integrates with Corpay - A Leading FX Risk Management Provider, it allowes all trades and analytics have in one place

Founders Hub

It is with great pleasure that we announce CorpHedge's integration into the esteemed Microsoft for Startups Founders Hub.

Volatility can be controlled!

We see huge volatility in all the financial markets - even safest financial instruments (bonds) face high volatility environment.