Private equity investments in Georgia

Published: 2020-09-19

Georgia as other emerging markets can be and are interesting opportunity for Private equity firms. But due to low level capital markets in this country, to hedge Georgian lari can be real headache due to dry liquidity and large spreads. CorpHedge Networks was created especially to fix that problem for members and allow participants to find liquidity from other peers in our database. All members put their requirements into a platform as pending orders. For example, Company X will start investing into Georgia after 3 months. Once the company is able to plan cash flows, put these requirements into a platform. CorpHedge algorithm shows how much of these flows it will be able to hedge through the platform. Order is prepared for execution after 3 months with required expiration dates and are in pending status - that means other joiners can join the contracts until execution time. 72 hours before the execution time countdown starts and trades is executed at the agreed time.

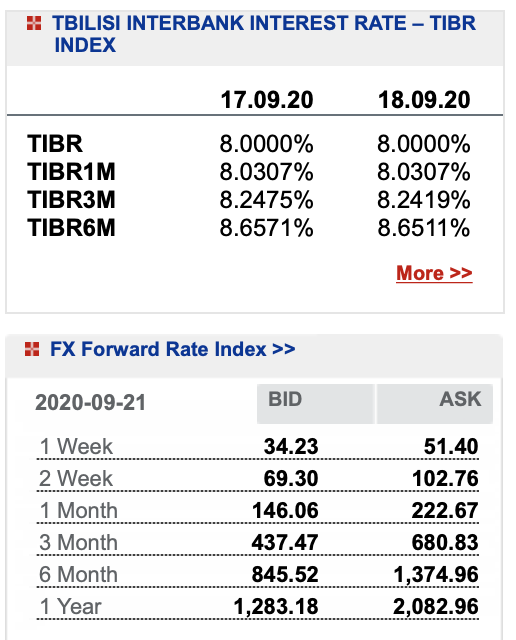

These are the rates from Georgian national bank. Spreads between bid and ask are substantial. In a Corphedge, participants are allowed to trade direct with each other. Via CorpHedge, participants will be able to deal inside that range. No extra spread on that. So substantial saving can be offered. Network offers banks opportunity to monetise their balance sheets through offering credit facilities for the P2P trades in our database.

Example:

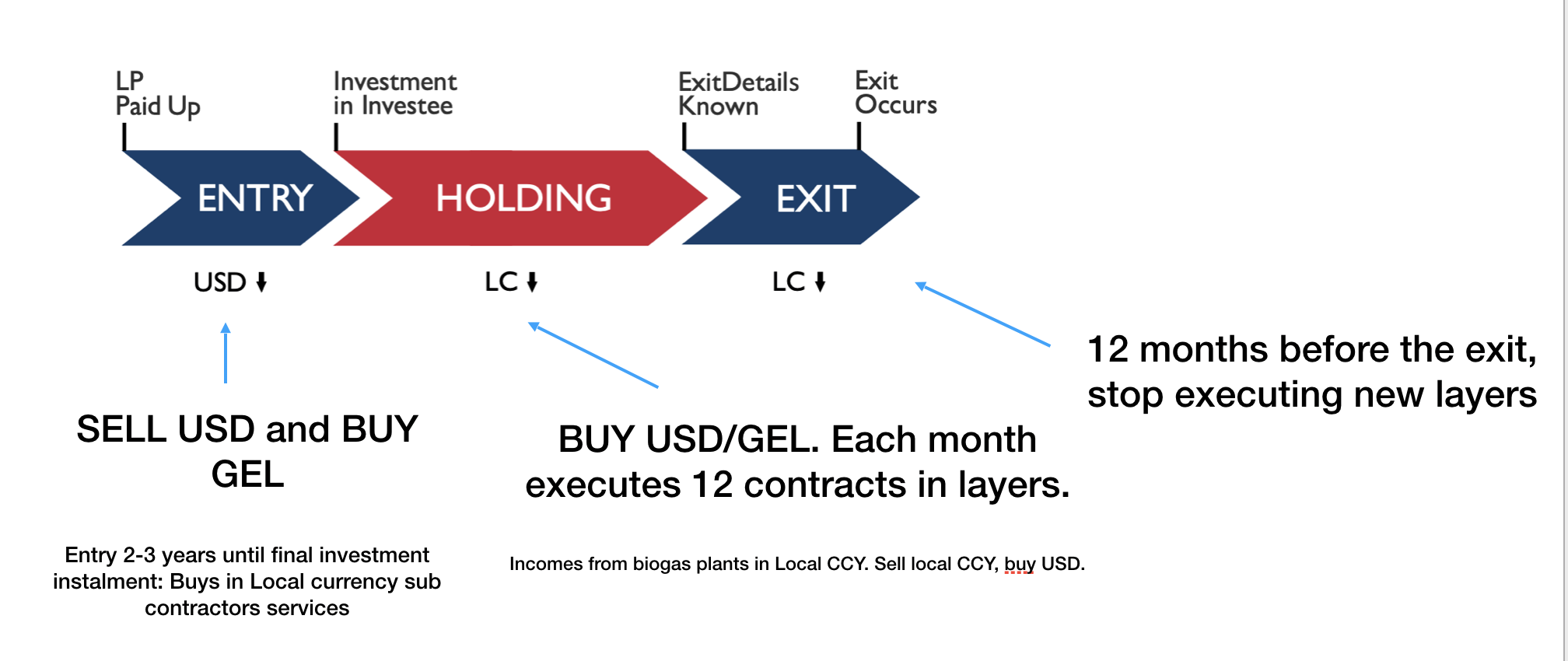

PE company from US invests in Georgian market. The company chooses to work on layered hedging strategies and in this way reduce volatility over long time frame

An approach is to reduce volatility in FX over longer time frame.

Executes 12 month layered hedge strategies. From the 12th month fully hedged. Hedging half portion of all flows. 25 mln sum divides from 53 months. Monthly requirements for NDF contract would be 471k USD sell GEL/USD.

Strategy offers huge VaR reduction and reduces volatility substantially. Secures from fat tail events risk.

Each month both sides exchange (cash settle) the difference between the spot rate and fixed contract rate.

Most companies prefer flows type hedge as their projects are longer term and their need is to reduce volatility over longer time frame and to create as an alternative SPOT rate instead of fix all flows in one big trade.

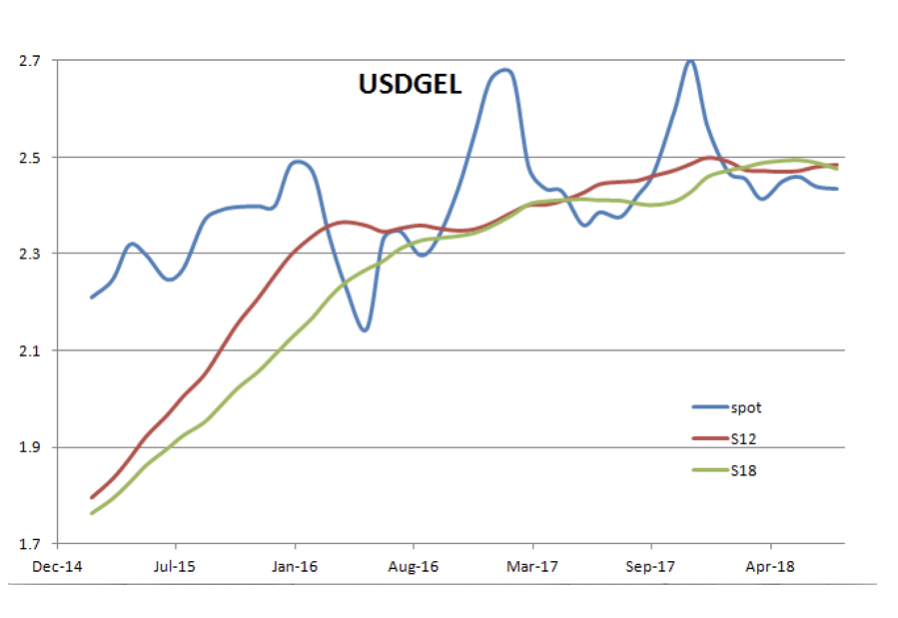

12 months (S12) and 18 months (S18) layered hedging strategy

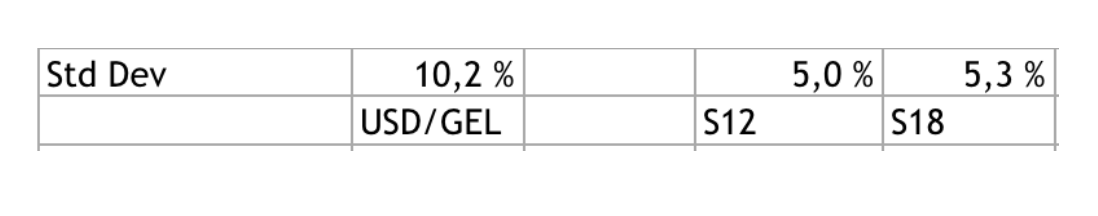

Volatility reduction: